What is CPI Report Today? CPI Report Today is a monthly report that tracks inflation and consumer spending trends. It is published by the Bureau of Labor Statistics (BLS) and is a key indicator of the overall health of the economy.

Editor's Notes: CPI Report Today: Tracking Inflation And Consumer Spending Trends have published today date. CPI Report Today is an important report because it provides insights into how inflation is affecting consumers and businesses. This information can be used to make informed decisions about economic policy.

Our team has analyzed the latest CPI Report Today data and compiled this guide to help you understand the key findings. We'll cover what the report says about inflation, consumer spending, and the overall economic outlook.

Key differences or Key takeways

| CPI Report Today | |

|---|---|

| Release Date | Monthly |

| Publisher | Bureau of Labor Statistics (BLS) |

| Measures | Changes in consumer prices and spending |

| Importance | Provides insights into inflation and consumer spending trends |

Main article topics

FAQ

Access the latest consumer price index (CPI) figures and analyses on CPI Report Today: Tracking Inflation And Consumer Spending Trends.

May 2024 Cpi Report - Kiele Merissa - Source reybcarmita.pages.dev

Question 1: What is the CPI?

The CPI is a measure of the average change over time in the prices paid by urban consumers for a basket of goods and services. It is a key indicator of inflation and is used to adjust wages, benefits, and other economic indicators.

Question 2: How is the CPI calculated?

The CPI is calculated by the Bureau of Labor Statistics (BLS) by surveying the prices of over 80,000 items in 87 urban areas across the country. The BLS collects data on prices for a variety of goods and services, including food, housing, transportation, and healthcare.

Question 3: How often is the CPI released?

The CPI is released monthly by the BLS. The data is typically released on the second Tuesday of each month.

Question 4: What are the limitations of the CPI?

The CPI is not a perfect measure of inflation. It does not include the prices of all goods and services, and it does not account for changes in quality. Additionally, the CPI can be affected by seasonal factors and other temporary price fluctuations.

Question 5: How is the CPI used?

The CPI is used by a variety of stakeholders, including policymakers, businesses, and consumers. Policymakers use the CPI to make decisions about monetary and fiscal policy. Businesses use the CPI to adjust wages and prices. Consumers use the CPI to track inflation and make informed spending decisions.

Question 6: What are the alternatives to the CPI?

There are a number of alternative measures of inflation, including the Producer Price Index (PPI) and the Personal Consumption Expenditures (PCE) Price Index. Each of these measures has its own strengths and weaknesses. The CPI is the most widely used measure of inflation, but it is important to be aware of the limitations of the index.

The CPI is a valuable tool for understanding inflation and consumer spending trends. However, it is important to be aware of the limitations of the index and to use it in conjunction with other measures of inflation.

Learn more about the CPI Report Today: Tracking Inflation And Consumer Spending Trends.

Tips

The Consumer Price Index (CPI) is a crucial economic indicator that measures inflation and consumer spending trends. By understanding how to interpret the CPI report, individuals and businesses can make informed decisions about their finances and economic activities.

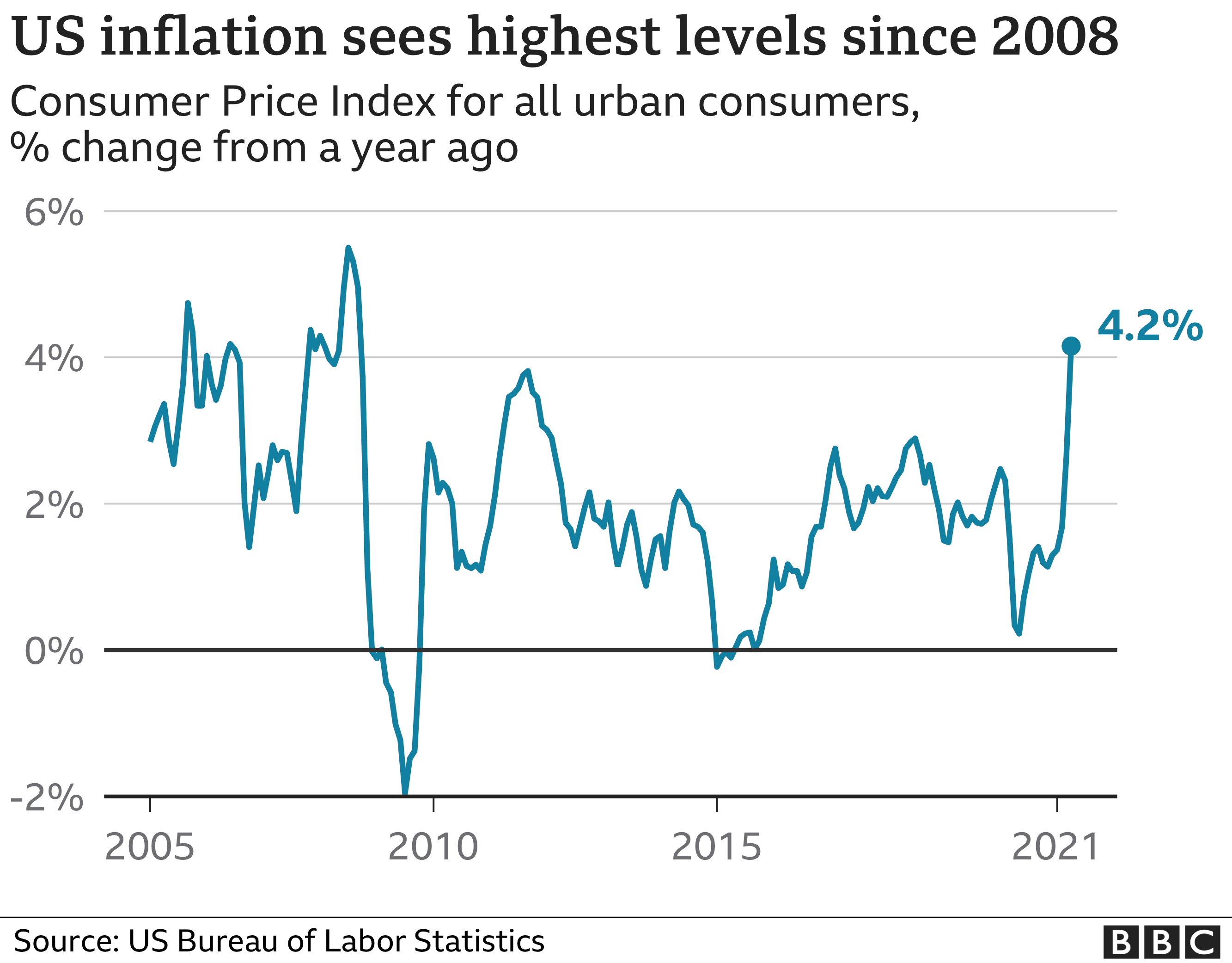

US inflation sees biggest jump since 2008 - BBC News - Source www.bbc.com

Tip 1: Examine the headline inflation rate.

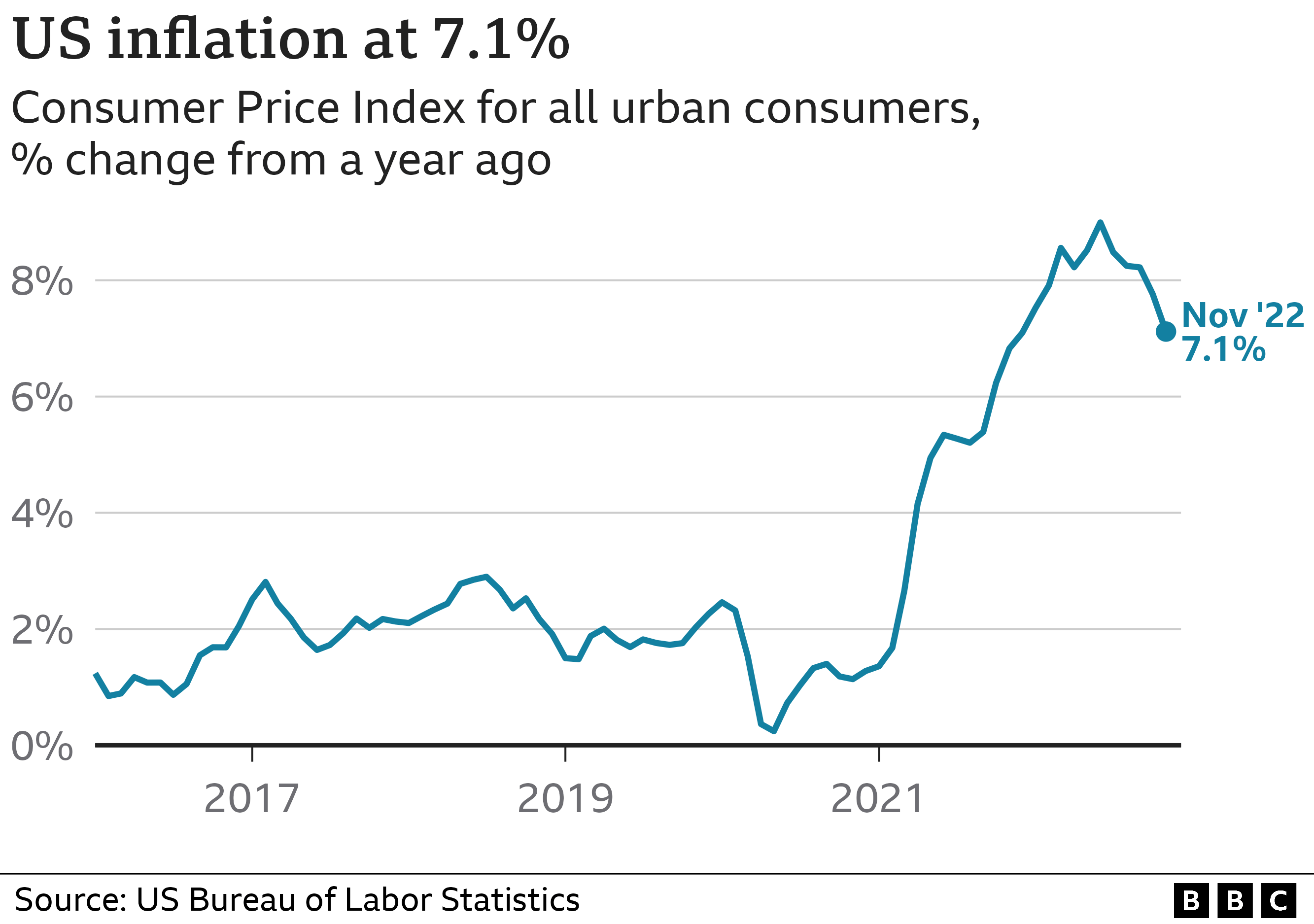

The headline inflation rate represents the overall change in the prices of goods and services in the economy over a specified period, usually one month or a year. It provides a broad indicator of inflation trends and can influence interest rate decisions and other economic policies.

Tip 2: Analyze the core inflation rate.

The core inflation rate excludes volatile components such as food and energy prices, which can be influenced by external factors. By focusing on the core rate, policymakers can better assess underlying inflation trends and make more accurate monetary policy decisions.

Tip 3: Consider the impact on specific sectors.

The CPI report provides detailed information on price changes across different goods and services categories. This information helps businesses identify areas where inflation is accelerating or decelerating, allowing them to adjust their pricing strategies or explore new market opportunities.

Tip 4: Monitor consumer spending patterns.

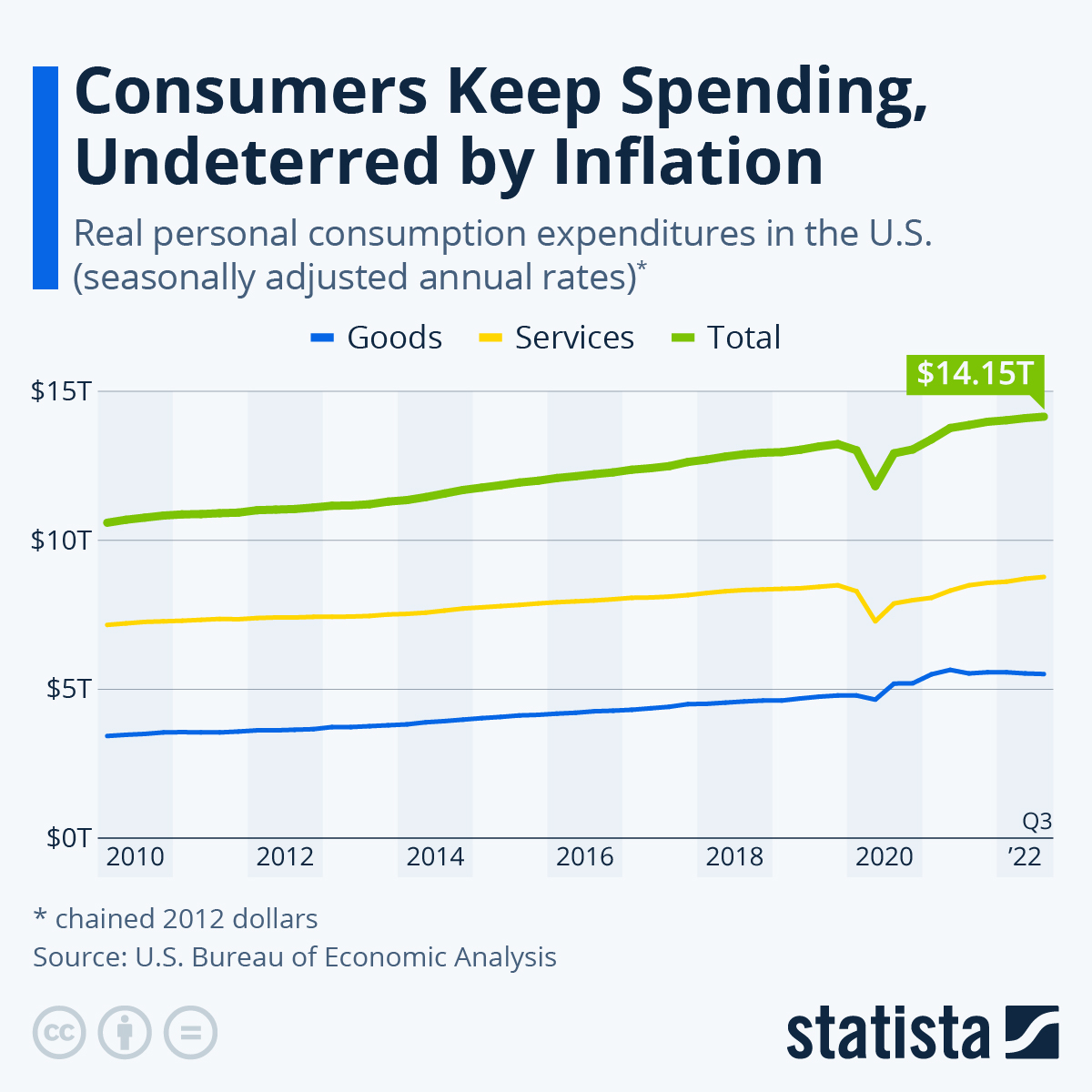

The CPI report also includes data on consumer spending, which provides insights into the health of the economy and household financial situations. Tracking consumer spending trends can help economists and policymakers anticipate future economic growth or potential slowdown.

Tip 5: Use historical comparisons.

Comparing the current CPI report to historical data can provide context and help identify long-term trends and patterns. By doing so, individuals and businesses can better assess the significance of current inflation rates and make informed projections about the future.

Understanding how to interpret the CPI report empowers individuals and businesses to make informed decisions based on accurate and timely inflation and consumer spending information.

In conclusion, the CPI report is a valuable tool for tracking inflation and consumer spending trends, and by following these tips, individuals and businesses can effectively utilize this information to their advantage.

CPI Report Today: Tracking Inflation And Consumer Spending Trends

The Consumer Price Index (CPI) report released today offers a wealth of insights into the dynamics of inflation and consumer spending trends. It provides crucial information for policymakers, investors, businesses, and consumers to gauge the overall economic health.

- Inflation Indicators: CPI measures price changes in a basket of goods and services, indicating inflation trends.

- Core Inflation: CPI excluding volatile food and energy prices provides a clearer picture of underlying inflationary pressures.

- Consumer Spending Habits: Changes in CPI components reflect shifts in consumer spending patterns, indicating demand trends.

- Policy Decisions: CPI data influences monetary policy decisions by central banks, impacting interest rates and economic growth.

- Business Planning: CPI provides businesses with insights into consumer preferences and helps them adjust pricing and product offerings.

- Market Expectations: CPI data is closely watched by financial markets, as-is market expectations for inflation and economic growth are adjusted accordingly.

These aspects of the CPI report provide a comprehensive view of inflation, consumer spending, and their implications. They help policymakers craft appropriate monetary policies, businesses adapt to changing market conditions, and consumers make informed financial decisions. By tracking CPI data over time, we can gain a deeper understanding of the economic landscape and its impact on our daily lives.

California Inflation Percentage 2024 Us - Faith Jasmine - Source gwendolinwlayla.pages.dev

CPI Report Today: Tracking Inflation And Consumer Spending Trends

The Consumer Price Index (CPI) report is a key economic indicator that measures inflation and tracks consumer spending trends in the United States. It is released monthly by the Bureau of Labor Statistics (BLS) and provides insights into the cost of living and the overall health of the economy.

Why did inflation spiral out of control: a retrospective – Grey - Source greyenlightenment.com

The CPI report is closely watched by economists, businesses, and consumers as it provides valuable information about the rate of inflation, which is the rate at which prices for goods and services increase over time. The report also provides data on consumer spending trends, showing how much money consumers are spending on different categories of goods and services.

The CPI report is used by the Federal Reserve to make decisions about interest rates. Interest rates are a key factor in determining the cost of borrowing money and can impact consumer spending and economic growth.

The CPI report is also used by businesses to make decisions about pricing and production levels. By tracking inflation and consumer spending trends, businesses can adjust their strategies to meet the needs of the market.

The CPI report is an important tool for understanding the current and future economic conditions in the United States. By tracking inflation and consumer spending trends, the report provides valuable information that can help businesses and consumers make informed decisions.

Conclusion

The CPI report today provides a key indicator of inflation and consumer spending trends in the United States. It helps provide insight into the cost of living and the overall health of the economy, influencing decision-making for businesses, consumers, and policymakers.

As the CPI report today becomes increasingly crucial, the data it provides will continue to shape economic policies, business strategies, and consumer behaviors.