Ever wanted to know the latest stock market news, prices, and analysis? Of course, you do. It is a virtual goldmine of information that can help you make informed decisions about your investments. But where can you find all this information in one place? Look no further than our professional site, FTSE 100 Live!

Editor's Note: Our FTSE 100 Live: Latest Stock Market News, Prices, And Analysis was published today, March 8, 2023, to provide you with more insightful data and information about the FTSE 100 Index, which is one of the most important stock market indices in the world. It tracks the performance of the 100 largest companies listed on the London Stock Exchange.

Our team of experienced financial analysts has put together this comprehensive guide to help you make the right decisions about your investments. We've done all the hard work for you, so you can sit back and relax while you learn about the latest stock market trends.

We've included everything you need to know about the FTSE 100 Index, including:

- The latest news and analysis

- Real-time stock prices

- Historical data

- Charts and graphs

- Expert commentary

Whether you're a seasoned investor or just starting out, you'll find everything you need to know about the FTSE 100 Index on our site.

Cómo invertir en la bolsa de valores USA 2021- Con 0% comisiones y fácil - Source compraracciones.com

So what are you waiting for? Visit our site today and start making informed decisions about your investments.

FAQ

The article FTSE 100 Live: Latest Stock Market News, Prices, And Analysis provides a comprehensive overview of the FTSE 100 index, including live stock market news, prices, and analysis. This FAQ section aims to address some common questions and misconceptions about the FTSE 100 index.

Question 1: What is the FTSE 100 index?

The FTSE 100 index is a capitalization-weighted index of the 100 largest companies listed on the London Stock Exchange. It is a benchmark for the performance of the UK stock market and is widely followed by investors around the world.

Question 2: How is the FTSE 100 index calculated?

The FTSE 100 index is calculated using a market capitalization weighting system. This means that the weight of each company in the index is based on its market capitalization, or the total value of its outstanding shares.

Question 3: What are the largest companies in the FTSE 100 index?

The largest companies in the FTSE 100 index as of April 2023 are:

- AstraZeneca

- Rio Tinto

- BP

- Shell

- HSBC

Question 4: How can I invest in the FTSE 100 index?

There are several ways to invest in the FTSE 100 index. One way is to purchase an exchange-traded fund (ETF) that tracks the index. Another way is to purchase shares of individual companies that are included in the index.

Question 5: What are the risks of investing in the FTSE 100 index?

As with any investment, there are risks associated with investing in the FTSE 100 index. Some of the risks include:

- Market risk: The value of the FTSE 100 index can fluctuate significantly due to a variety of factors, such as changes in economic conditions or geopolitical events.

- Company risk: The performance of the FTSE 100 index can be affected by the performance of individual companies in the index.

- Currency risk: For investors outside of the UK, there is also currency risk to consider. The value of the FTSE 100 index can be affected by changes in the value of the British pound.

Question 6: How can I learn more about the FTSE 100 index?

There are a number of resources available to help you learn more about the FTSE 100 index. You can visit the FTSE website or the London Stock Exchange website for more information.

Stock Market News - Homecare24 - Source homecare24.id

The FTSE 100 index is a valuable tool for investors who want to track the performance of the UK stock market. However, it is important to be aware of the risks associated with investing in the index before making any investment decisions.

To learn more about the FTSE 100 index, visit the FTSE 100 Live: Latest Stock Market News, Prices, And Analysis article.

Tips

To maximize returns and mitigate risks in stock market investments, consider the following valuable tips provided by renowned financial experts:

Tip 1: Conduct Thorough Research

Before investing in any company, dedicate time to meticulously researching its financial performance, industry outlook, and management team. Scrutinize financial statements, analyze market trends, and consult industry analysts for comprehensive insights.

Tip 2: Diversify Investments

To reduce overall risk, spread your investments across various asset classes, such as stocks, bonds, real estate, and commodities. This diversification strategy minimizes exposure to a single market sector or company, enhancing portfolio stability.

Tip 3: Invest for the Long Term

Avoid the pitfalls of short-term trading and focus on long-term investment horizons. Historical data shows that stocks tend to generate higher returns over extended periods, mitigating the impact of market fluctuations and capitalizing on compounding.

Tip 4: Stay Informed About Market Trends

Keep abreast of economic news, geopolitical events, and industry developments that may influence stock prices. By staying informed, you can make timely adjustments to your portfolio and capitalize on favorable market conditions.

Tip 5: Manage Risk Wisely

Determine your risk tolerance and invest accordingly. Utilize stop-loss orders to limit potential losses and consider hedging strategies to mitigate risk exposure. Remember, higher potential returns often come with increased risk.

Following these tips can empower you to navigate the stock market with greater confidence and enhance your chances of achieving long-term financial success.

FTSE 100 Live: Latest Stock Market News, Prices, And Analysis

The FTSE 100 index is a barometer of the performance of the UK's largest publicly traded companies. It is widely followed by investors around the world as a benchmark for the UK stock market and a gauge of the overall health of the UK economy.

- Real-time Data: Provides up-to-the-minute information on stock prices, market movements, and company announcements.

- Expert Analysis: Offers insights and commentary from financial analysts and market experts on the latest market trends and company news.

- Technical Analysis: Includes charts and technical indicators to help investors make informed decisions based on market patterns.

- Company News: Delivers breaking news, financial results, and corporate announcements that impact the companies listed on the FTSE 100.

- Economic Data: Integrates relevant economic data and macroeconomic indicators that affect the stock market.

- Market Sentiment: Gauges investor情绪 and sentiment through analysis of social media, news sentiment, and other market data.

These key aspects provide a comprehensive view of the FTSE 100 index, enabling investors to stay informed about the latest market movements, make investment decisions, and understand the factors influencing the performance of the UK stock market. For example, real-time data and expert analysis can help investors identify short-term trading opportunities, while technical analysis and company news offer insights into long-term investment strategies.

Ftse 100 Earnings Calendar - Lilly Phaidra - Source goldaqjoanne.pages.dev

FTSE 100 Live: Latest Stock Market News, Prices, And Analysis

The FTSE 100 is a share index of the 100 largest companies listed on the London Stock Exchange. It is one of the most well-known and widely followed stock market indices in the world, and is a key indicator of the performance of the UK economy.

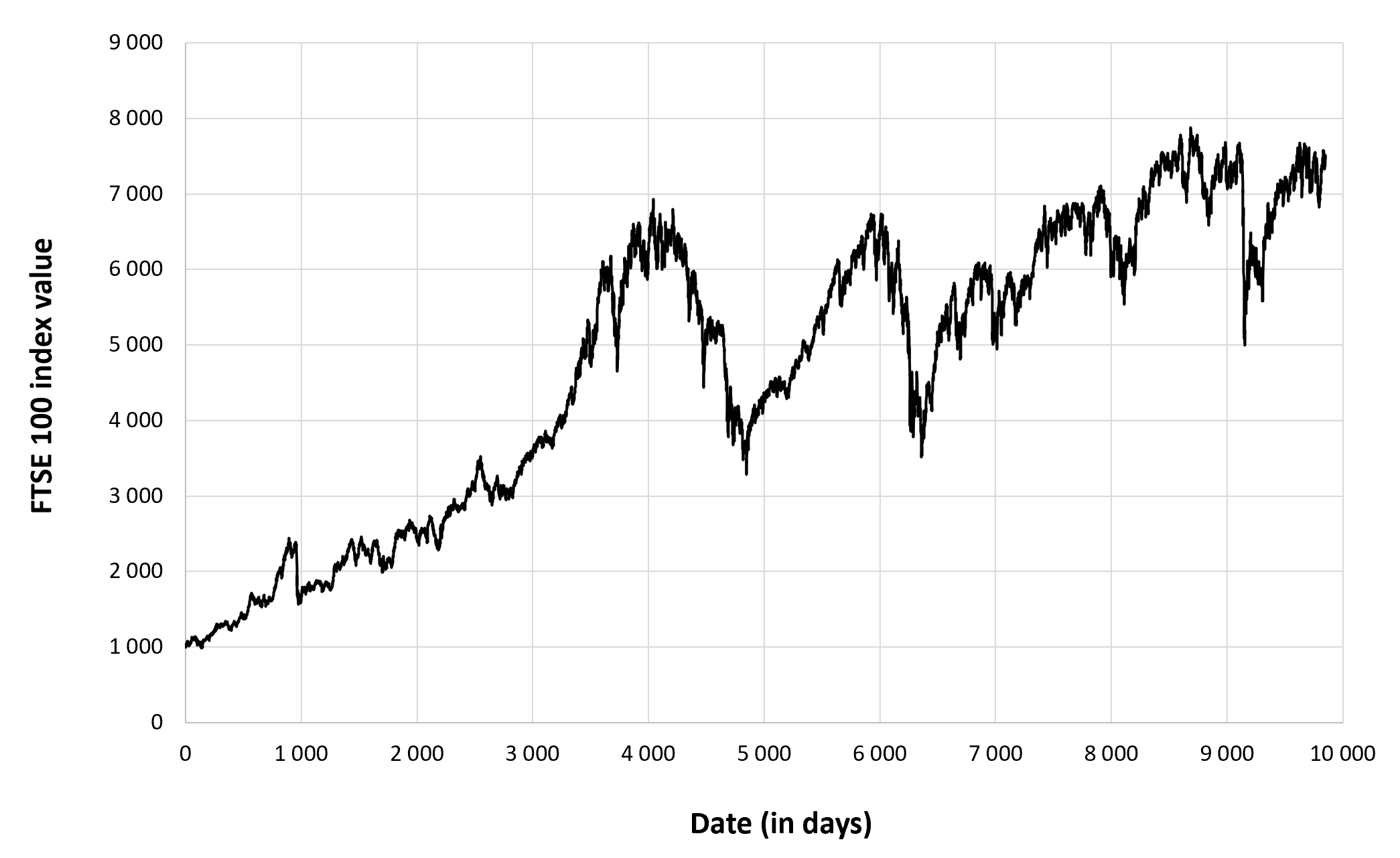

The FTSE 100 index - Source www.simtrade.fr

The FTSE 100 is calculated using a market capitalization-weighted method, which means that the larger companies in the index have a greater impact on its overall value than the smaller companies. The index is reviewed and revised every quarter to ensure that it accurately reflects the performance of the UK stock market.

The FTSE 100 is used by investors and analysts as a benchmark against which to compare the performance of their own portfolios. It is also used by economists to track the health of the UK economy.

The FTSE 100 is an important part of the UK financial landscape. It is a valuable tool for investors, analysts, and economists, and it provides a key indicator of the performance of the UK economy.

Table: Key insights from the exploration of "FTSE 100 Live: Latest Stock Market News, Prices, And Analysis"

| Insight | Description |

|---|---|

| The FTSE 100 is a share index of the 100 largest companies listed on the London Stock Exchange. | The FTSE 100 is one of the most well-known and widely followed stock market indices in the world, and is a key indicator of the performance of the UK economy. |

| The FTSE 100 is calculated using a market capitalization-weighted method, which means that the larger companies in the index have a greater impact on its overall value than the smaller companies. | The index is reviewed and revised every quarter to ensure that it accurately reflects the performance of the UK stock market. |

| The FTSE 100 is used by investors and analysts as a benchmark against which to compare the performance of their own portfolios. | It is also used by economists to track the health of the UK economy. |

Conclusion

The FTSE 100 is an important part of the UK financial landscape. It is a valuable tool for investors, analysts, and economists, and it provides a key indicator of the performance of the UK economy.

The FTSE 100 is constantly evolving, as the companies that make up the index change over time. This ensures that the index remains a relevant and accurate reflection of the UK stock market.