Maximize Your Retirement Income: Explore The Benefits Of Pension Credit

Analyzing retirement income and digging information, we made Maximize Your Retirement Income: Explore The Benefits Of Pension Credit. This will help our target audience make the right decision and get the benefits out of it.

Key differences or Key takeways

FAQ

Maximize Your Retirement Income: Explore The Benefits Of Pension Credit

Question 1: What is Pension Credit and who is eligible?

Pension Credit is a government benefit designed to supplement the income of low-income pensioners. To be eligible, one must be over state pension age, have less than £168,000 in savings and be living in the United Kingdom.

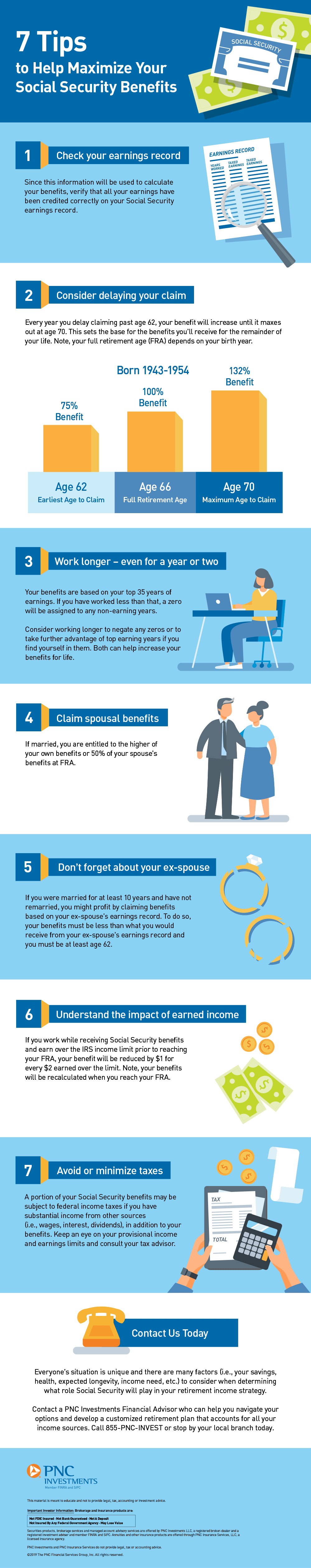

7 Tips to Help Maximize Your Social Security Benefits | PNC Insights - Source www.pnc.com

Question 2: How much Pension Credit can I receive?

The amount of Pension Credit you receive depends on your individual circumstances, including your age, income, savings, and whether you are living alone or with a partner.

Question 3: What are the benefits of claiming Pension Credit?

Claiming Pension Credit can provide a range of benefits, including a weekly income boost, help with housing costs, and access to other financial assistance programs.

Question 4: How do I apply for Pension Credit?

You can apply for Pension Credit online, by phone, or by post. You will need to provide information about your income, savings, and living arrangements.

Question 5: What happens if my circumstances change?

If your circumstances change, such as a change in income or living arrangements, it is important to report these changes to the Pension Service. Your Pension Credit payment may be affected.

Question 6: Where can I get more information about Pension Credit?

For more information about Pension Credit, you can visit the government website or contact the Pension Service.

Pension Credit is a valuable benefit that can help you improve your financial well-being in retirement. If you are eligible, we encourage you to claim it.

For more information on Pension Credit, visit the government website or contact the Pension Service.

Tips: Maximize Your Retirement Income: Explore The Benefits Of Pension Credit

Pension credit is a government benefit that can supplement your retirement income if you have low or no Social Security benefits. It's important to understand the eligibility requirements and how to apply for pension credit in order to maximize your retirement income.

Tip 1: Find Out If You're Eligible

You may be eligible for pension credit if you are:

- Age 65 or older

- A U.S. citizen or a permanent resident for at least 10 years

- Have income below certain limits

Tip 2: Apply for Pension Credit

To apply for pension credit, you need to complete the Form SSA-1017. You can get this form from the Social Security Administration (SSA) website or by calling your local SSA office.

Tip 3: Get Help With Your Application

If you need help with your application, you can contact the SSA or a local legal aid organization. These organizations can provide free or low-cost help with the application process.

Tip 4: Maximize Your Benefits

There are a few things you can do to maximize your pension credit benefits. First, make sure to apply for pension credit as early as possible. Second, if you are eligible for Social Security benefits, you should apply for those benefits as well. Third, you can increase your pension credit benefits by working longer and earning more income.

Tip 5: Check Your Pension Credit Statement

The SSA will send you a pension credit statement each year. This statement will show you how much pension credit you have earned and how much you are eligible to receive in benefits.

Summary of key takeaways or benefits

Pension credit can provide a significant boost to your retirement income. By understanding the eligibility requirements and following these tips, you can maximize your benefits and enjoy a more secure retirement.

Transition to the article's conclusion

If you have any questions about pension credit, you should contact the SSA for more information.

Maximize Your Retirement Income: Explore The Benefits Of Pension Credit

Planning for retirement is a crucial aspect of securing financial stability during your golden years. Maximizing your retirement income is essential, and one way to do this is by exploring the benefits of pension credit. Pension credit can help supplement your retirement savings and provide you with a steady income stream in your later years.

Destination Retirement - Home - Source web.destinationretirement.co.uk

- Enhanced Income: Pension credit can increase your monthly income, providing a boost to your retirement savings.

- Reduced Tax Burden: Pension credit is often tax-advantaged, resulting in lower tax liability and higher income.

- Improved Quality of Life: Increased income can enhance your quality of life in retirement, allowing you to pursue hobbies, travel, or spend time with loved ones.

- Reduced Financial Stress: A reliable income stream can reduce financial stress, providing peace of mind and security.

- Increased Savings: Pension credit can free up other savings for investment or unexpected expenses, further increasing your retirement nest egg.

- Estate Planning: Pension credit can be used as part of an estate plan, ensuring your financial legacy.

In addition to the benefits listed above, pension credit is also portable, meaning you can take it with you if you change jobs or retire from multiple employers. This provides flexibility and ensures that you will continue to receive the benefits regardless of your work history. Furthermore, pension credit can be combined with other retirement income sources, such as Social Security and personal savings, to create a comprehensive retirement plan that meets your individual needs.

Maximize Your Retirement Income: Explore The Benefits Of Pension Credit

When planning for retirement, it is important to explore all available options to ensure a secure financial future. One often overlooked benefit is the Pension Credit, which can provide a significant boost to retirement income for those who qualify.

Home - Federal Benefits Educators Group - Source federalbenefiteducatorsgroup.com

The Pension Credit is a tax credit that supplements the income of low-income retirees. To be eligible, individuals must have reached State Pension age, have limited savings and income, and have lived in the UK for a certain amount of time. The amount of Pension Credit received depends on individual circumstances, but it can provide a substantial increase in retirement income.

There are numerous benefits to claiming the Pension Credit. It can help to:

- Increase retirement income, reducing the risk of poverty in old age.

- Qualify for additional benefits, such as Housing Benefit and Council Tax Reduction.

- Access free NHS dental treatment and eye tests.

Despite the clear advantages, many eligible individuals are not claiming the Pension Credit. This could be due to lack of awareness, misconceptions about eligibility, or a complex application process. It is important to encourage those who may be eligible to apply and to provide support throughout the process.

The Pension Credit is a valuable benefit that can make a significant difference to the lives of low-income retirees. By raising awareness and simplifying the application process, we can ensure that more people are able to access this important financial support.

Table: Key benefits of Pension Credit

| Benefit | Description |

|---|---|

| Increased retirement income | Provides a tax-free income boost to low-income retirees. |

| Access to additional benefits | Can qualify for benefits such as Housing Benefit and Council Tax Reduction. |

| Free healthcare benefits | Entitles recipients to free NHS dental treatment and eye tests. |

Conclusion

In conclusion, the Pension Credit is a crucial benefit that can significantly enhance the financial security of low-income retirees. Its potential to reduce poverty, provide access to additional support, and improve health outcomes is substantial.

Raising awareness, simplifying the application process, and providing ongoing support to eligible individuals are essential to ensure that more people can access this important financial assistance. By maximizing the uptake of Pension Credit, we can create a more just and equitable society for all.