Navy Federal: Seamless Banking And Financial Solutions For Military Members And Families

Editor's Notes: Navy Federal: Seamless Banking And Financial Solutions For Military Members And Families has published today date. This topic is important to read because it provides an overview of the banking and financial services offered by Navy Federal Credit Union, which is a leading financial institution serving military members and their families.

After analyzing the facts and digging the information, we put together this Navy Federal: Seamless Banking And Financial Solutions For Military Members And Families guide to help target audience make the right decision.

Key Differences or Key Takeaways

Transition to main article topics

FAQ

Discover helpful answers to common questions regarding the financial services provided by Navy Federal: Seamless Banking And Financial Solutions For Military Members And Families

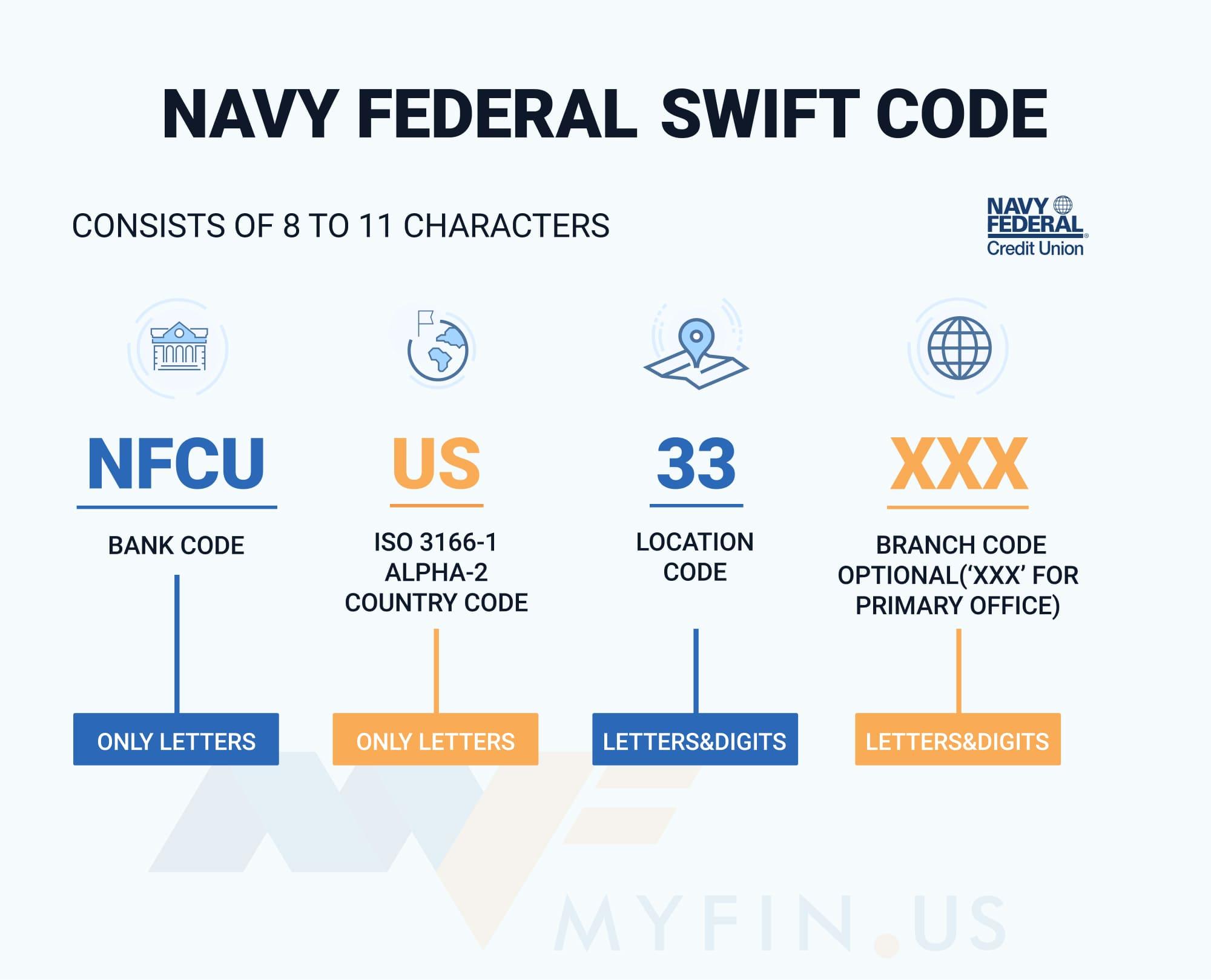

Navy Federal Credit Union SWIFT/BIC Code is NFCUUS33 — Find Your SWIFT - Source myfin.us

Question 1: What makes Navy Federal distinct from other financial institutions?

Navy Federal is dedicated solely to serving the financial needs of military members and their families, providing specialized products and services tailored to their unique circumstances.

Question 2: What types of accounts does Navy Federal offer?

Navy Federal offers a comprehensive range of accounts, including checking and savings accounts, money market accounts, certificates of deposit, and IRAs, among others.

Question 3: How do I access my Navy Federal account online or through mobile banking?

You can manage your Navy Federal account conveniently through online banking or the mobile app, available for both iOS and Android devices. The app allows you to check balances, transfer funds, pay bills, and more.

Question 4: What security measures does Navy Federal implement to protect my financial information?

Navy Federal employs robust security measures, including multi-factor authentication, encryption, and fraud monitoring systems, to safeguard your sensitive information and protect against unauthorized access.

Question 5: Does Navy Federal offer financial planning and guidance?

Yes, Navy Federal provides access to financial advisors who can assist you with personalized financial planning, budgeting, investment strategies, and more.

Question 6: How can I contact Navy Federal for assistance or inquiries?

You can contact Navy Federal through multiple channels, including phone, email, secure messaging, or by visiting a branch location. The customer service team is available 24/7 to provide support and answer your questions.

Navy Federal remains committed to providing exceptional banking and financial solutions to the military community, ensuring their financial well-being and peace of mind.

Explore the Navy Federal website to learn more about their products, services, and exclusive benefits for military members and families.

Tips from Navy Federal

Navy Federal Credit Union, dedicated to serving military members and their families, offers these valuable banking tips to help individuals manage their finances effectively.

Tip 1: Create a Budget

Develop a detailed budget that outlines income and expenses. Tracking cash flow helps identify areas for optimization and prevents overspending.

Tip 2: Save Regularly

Establish automatic transfers from a checking to a savings account to build a financial cushion. Even small amounts saved consistently can accumulate over time.

Tip 3: Reduce Debt

Prioritize paying down high-interest debts to minimize interest charges. Consider debt consolidation or refinancing options to secure lower rates.

Tip 4: Build Credit

Make timely payments on loans and credit cards. Limit credit utilization and maintain a diverse credit portfolio to improve credit scores.

Tip 5: Maximize Military Benefits

Explore military-specific benefits such as the Savings Deposit Program and military discounts. These perks can supplement income and reduce expenses.

Tip 6: Seek Financial Counseling

Navy Federal offers free financial counseling services. Certified counselors provide personalized guidance and support to help individuals achieve financial goals.

Tip 7: Plan for Retirement

Begin saving for retirement early through the Thrift Savings Plan or an Individual Retirement Account. Take advantage of employer contributions and tax benefits.

Tip 8: Protect Your Finances

Utilize Navy Federal's online and mobile banking services to monitor transactions, set up alerts, and protect against fraud. Keep personal information secure.

Remember, financial well-being is essential for stability and future success. By implementing these tips, individuals can navigate their financial journey with confidence and ease.

Navy Federal: Seamless Banking And Financial Solutions For Military Members And Families

Navy Federal Credit Union, the world’s largest credit union serving the U.S. military and their families, has long been revered for its unwavering commitment to providing unparalleled financial services. At the bedrock of Navy Federal's success lies a robust foundation comprising six essential pillars that seamlessly integrate banking and financial solutions:

Navy Federal Bank Statement Template - Printable Word Searches - Source davida.davivienda.com

- Tailored Products: Navy Federal tailors products exclusively catering to military needs, such as low-interest loans, affordable insurance, and flexible savings accounts.

- Convenient Accessibility: With over 330 branches globally and online/mobile banking options, Navy Federal ensures banking convenience for members wherever they may be.

- Personal Service: Dedicated financial advisors provide personalized assistance, offering tailored guidance and support to members facing unique financial circumstances.

- Financial Guidance: Navy Federal proactively provides financial literacy resources, seminars, and counseling to empower members with financial knowledge and decision-making skills.

- Commitment to Security: Navy Federal employs cutting-edge security measures and fraud protection protocols to safeguard members' financial well-being.

li>Strong Community Ties: Navy Federal actively participates in military communities through sponsorships, volunteerism, and outreach programs, fostering a sense of belonging and support.

Through these intertwined aspects, Navy Federal transcends mere banking to become an indispensable financial partner for military members and families, providing them with the stability, security, and financial empowerment they need to navigate the complexities of military life. Their dedication to serving those who serve is a testament to their unwavering support and commitment to the military community.

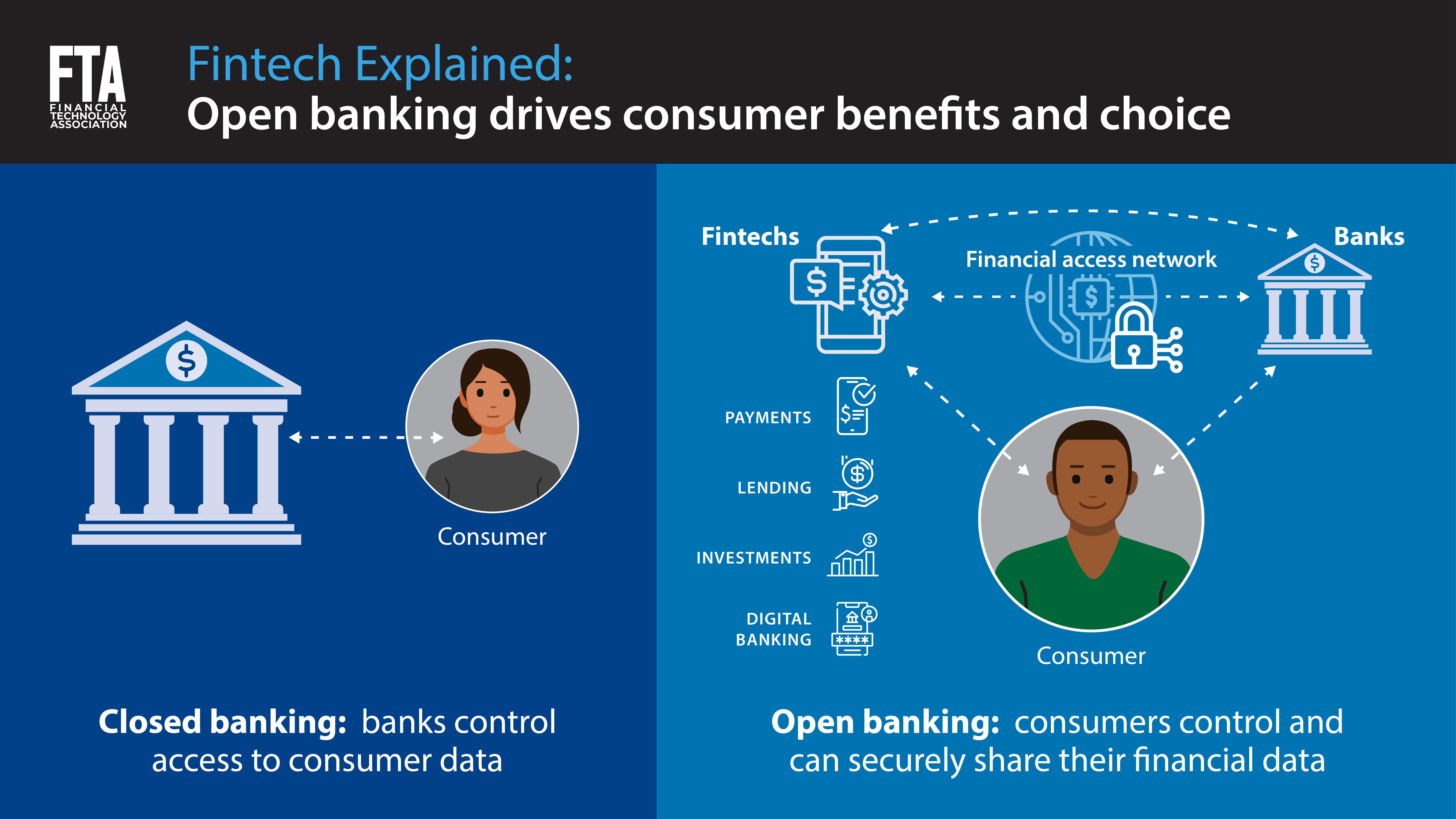

Fintech Explained: Open Banking Drives Consumer Benefits and Choice - Source www.ftassociation.org

Navy Federal: Seamless Banking And Financial Solutions For Military Members And Families

Navy Federal Credit Union is a member-owned financial institution that provides banking and financial services to active duty military personnel, veterans, and their families. Navy Federal was founded in 1933 by a group of Navy personnel who pooled their money to help each other out financially. Today, Navy Federal is the largest credit union in the world, with over 10 million members and over $130 billion in assets.

Pin by Teena Phillimeano on Extended stay motel August 2021 | Creative - Source www.pinterest.com

Navy Federal offers a wide range of financial products and services, including checking and savings accounts, credit cards, loans, and mortgages. Navy Federal is also a leader in providing financial education and counseling to military members and their families. Navy Federal's commitment to serving military members and their families is evident in everything they do. They offer a variety of programs and services that are tailored to the unique needs of military families, such as:

Conclusion

Navy Federal is a valuable resource for military members and their families. They offer a wide range of financial products and services that are tailored to the unique needs of military families. Navy Federal's commitment to serving military members and their families is evident in everything they do.

Navy Federal is a great example of a financial institution that is committed to making a difference in the lives of its members. Their programs and services are designed to help military members and their families achieve their financial goals.