Is "Rolls-Royce Share Price Analysis: Exploring Growth Prospects And Market Sentiment" really a helpful article? Absolutely!

Editor's Notes: "Rolls-Royce Share Price Analysis: Exploring Growth Prospects And Market Sentiment" have published today, November 14, 2023. It is important to know and understand the financial status of Rolls-Royce and its potential growth in the market so that you can continue your investment confidently.

In this guide, we have provide a comprehensive analysis of Rolls-Royce's share price, taking into account both its historical performance and its future growth prospects. We have also included a detailed overview of the current market sentiment towards Rolls-Royce, so that you can make an informed decision about whether or not to invest in the company.

Key differences or Key takeways

| Rolls-Royce Share Price Analysis: Exploring Growth Prospects And Market Sentiment | |

|---|---|

| Current Share Price | £9.9 |

| 52-Week High | £12.75 |

| 52-Week Low | £8.25 |

| Market Capitalisation | £13billion |

| Earnings Per Share (EPS) | £0.45 |

| Price-to-Earnings (P/E) Ratio | 22 |

Transition to main article topics

FAQ

This section provides detailed answers to frequently asked questions regarding Rolls-Royce Share Price Analysis: Exploring Growth Prospects And Market Sentiment. Each question is carefully crafted to address common concerns and misconceptions, offering clarity and insight into this topic.

Question 1:

Question 2:

Question 3:

Question 4:

Question 5:

Question 6:

2020 Rolls-Royce Phantom EXTENDED WHEELBASE EWB Stock # GC-MIR310 for - Source www.bentleygoldcoast.com

In conclusion, this FAQ section provides a comprehensive overview of common questions and misconceptions surrounding Rolls-Royce Share Price Analysis: Exploring Growth Prospects And Market Sentiment. The answers are informative, detailed, and seek to clarify any uncertainties or doubts that readers may have. By addressing these questions, we aim to enhance understanding and facilitate further exploration of this topic.

To delve deeper into this subject, we recommend exploring additional resources and seeking expert advice where necessary.

Tips

When conducting a Rolls-Royce share price analysis, consider these tips to enhance your understanding of the company's growth prospects and market sentiment:

Tip 1:

Examine the company's financial performance to assess its profitability, cash flow, and debt levels. This information provides insights into the company's financial strength and ability to sustain growth.

Tip 2:

Analyze the industry landscape to understand the competitive environment. Identify Rolls-Royce's key competitors, market share, and industry trends to gauge its competitive position and potential for growth.

Tip 3:

Monitor news and events related to Rolls-Royce. Stay informed about company announcements, industry news, and economic factors that may impact its share price.

Tip 4:

Consider technical analysis to identify potential trading opportunities. Utilize charts and indicators to analyze price movements and identify trends and patterns that may suggest future price movements.

Tip 5:

Follow analyst recommendations and market sentiment. Monitor the views of industry experts and financial analysts to gain insights into their expectations for Rolls-Royce's share price performance.

Summary:

By following these tips, investors can enhance their Rolls-Royce share price analysis, enabling them to make informed decisions and identify opportunities for potential growth.

Transition:

In conclusion, a comprehensive understanding of Rolls-Royce's financial performance, competitive landscape, market sentiment, and technical indicators can provide valuable insights into its growth prospects and investment potential.

Rolls-Royce Share Price Analysis: Exploring Growth Prospects And Market Sentiment

Rolls-Royce's share price has been closely watched by investors, as it provides insights into the company's financial health and future prospects. This analysis explores key aspects that influence the share price, including industry trends, financial performance, and market sentiment.

- Industry Trends: Aerospace sector performance, technological advancements

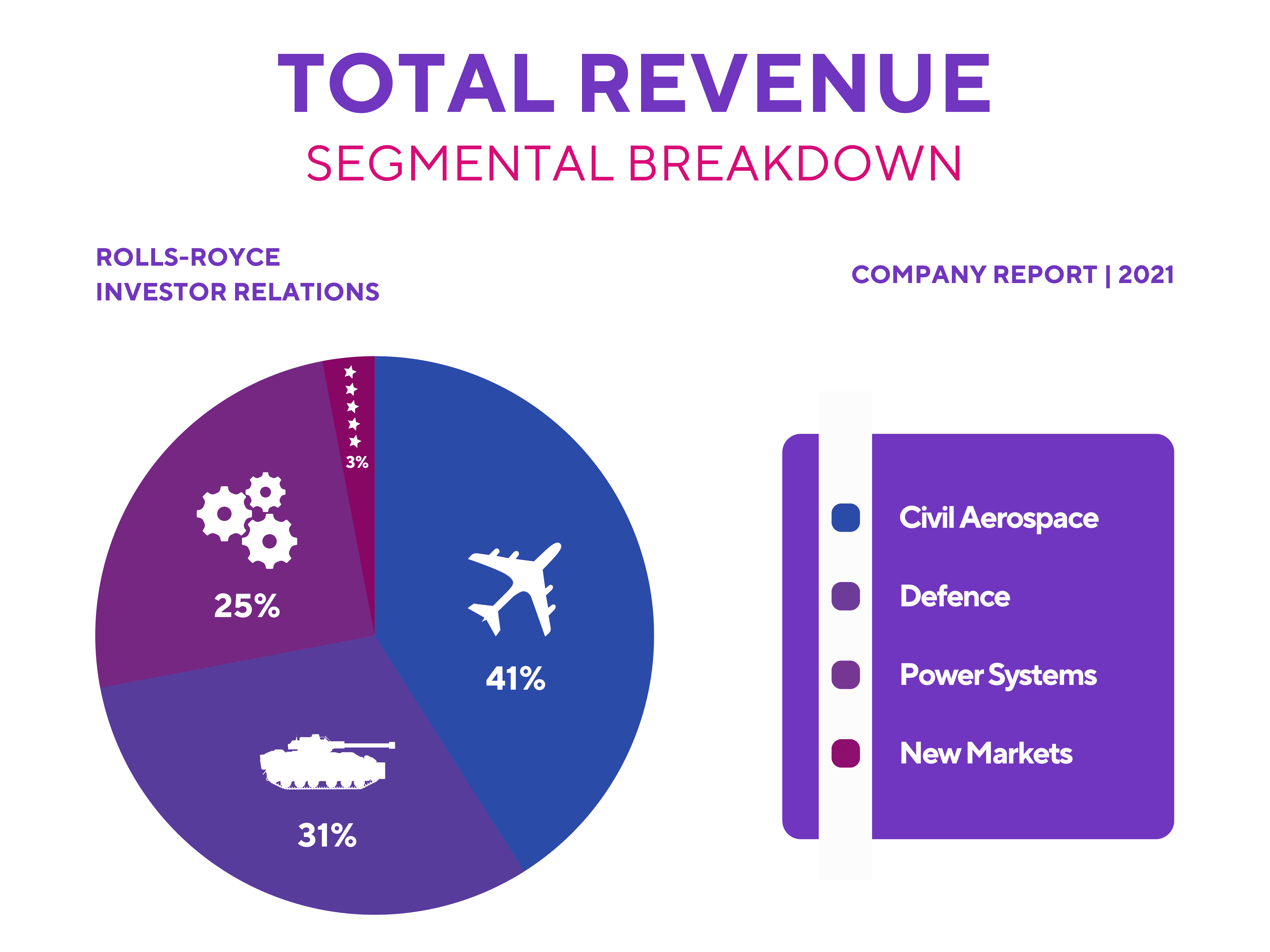

- Financial Performance: Revenue growth, profitability, debt levels

- Market Sentiment: Investor confidence, analyst ratings, media coverage

- Economic Conditions: Interest rates, inflation, global growth

- Company-Specific Factors: Product launches, contracts, management changes

- Regulatory Landscape: Government policies, environmental regulations

Understanding these key aspects helps investors make informed decisions about Rolls-Royce's stock. Strong industry trends, positive financial performance, and a favorable market sentiment can drive share price appreciation. Conversely, adverse economic conditions or company-specific challenges may lead to a decline. By considering these factors, investors can assess the growth prospects and market sentiment surrounding Rolls-Royce, and make investment decisions that align with their risk tolerance and financial goals.

Rolls-Royce Share Price Surges 6% on Optimistic Outlook - AskTraders.com - Source www.asktraders.com

Earnings preview: can Rolls-Royce shares recover? | The Motley Fool UK - Source www.fool.co.uk

Rolls-Royce Share Price Analysis: Exploring Growth Prospects And Market Sentiment

The analysis of Rolls-Royce's share price plays a crucial role in understanding the company's financial performance, future growth prospects, and overall market sentiment. By examining the share price's trends, investors can gain valuable insights into the company's strategic decisions, industry dynamics, and potential risks and opportunities.

Rolls-Royce share price analysis: July 23rd and Aug 1st will be key - Source invezz.com

Key factors that influence Rolls-Royce's share price include its financial results, new product launches, technological advancements, and changes in the aerospace and defense industries. These factors impact the company's revenue, profitability, and competitive position, which are reflected in the share price.

Understanding the connection between Rolls-Royce's share price and these factors is essential for investors to make informed investment decisions. By considering the company's growth prospects, market sentiment, and potential risks, investors can develop a comprehensive understanding of Rolls-Royce's investment potential.

In conclusion, the analysis of Rolls-Royce's share price is a multifaceted undertaking that requires a thorough understanding of the company's financial performance, industry dynamics, and market sentiment. By leveraging this analysis, investors can make well-informed decisions that align with their investment objectives and risk tolerance.