Vanguard S&P 500: A Comprehensive Guide To America's Premier Index Fund, is a must-read for any investor looking to understand the ins and outs of this iconic fund.

Editor's Notes: "Vanguard S&P 500: A Comprehensive Guide To America's Premier Index Fund" have published today date".

After some analysis, digging information, made Vanguard S&P 500: A Comprehensive Guide To America's Premier Index Fund we put together this Vanguard S&P 500: A Comprehensive Guide To America's Premier Index Fund guide to help target audience make the right decision.

Key differences or Key takeways, provide in informative table format

Transition to main article topics

FAQs

This comprehensive FAQ section provides answers to frequently asked questions about the Vanguard S&P 500 index fund. Gain a deeper understanding of its composition, performance, and suitability for various investment strategies. Vanguard S&P 500: A Comprehensive Guide To America's Premier Index Fund

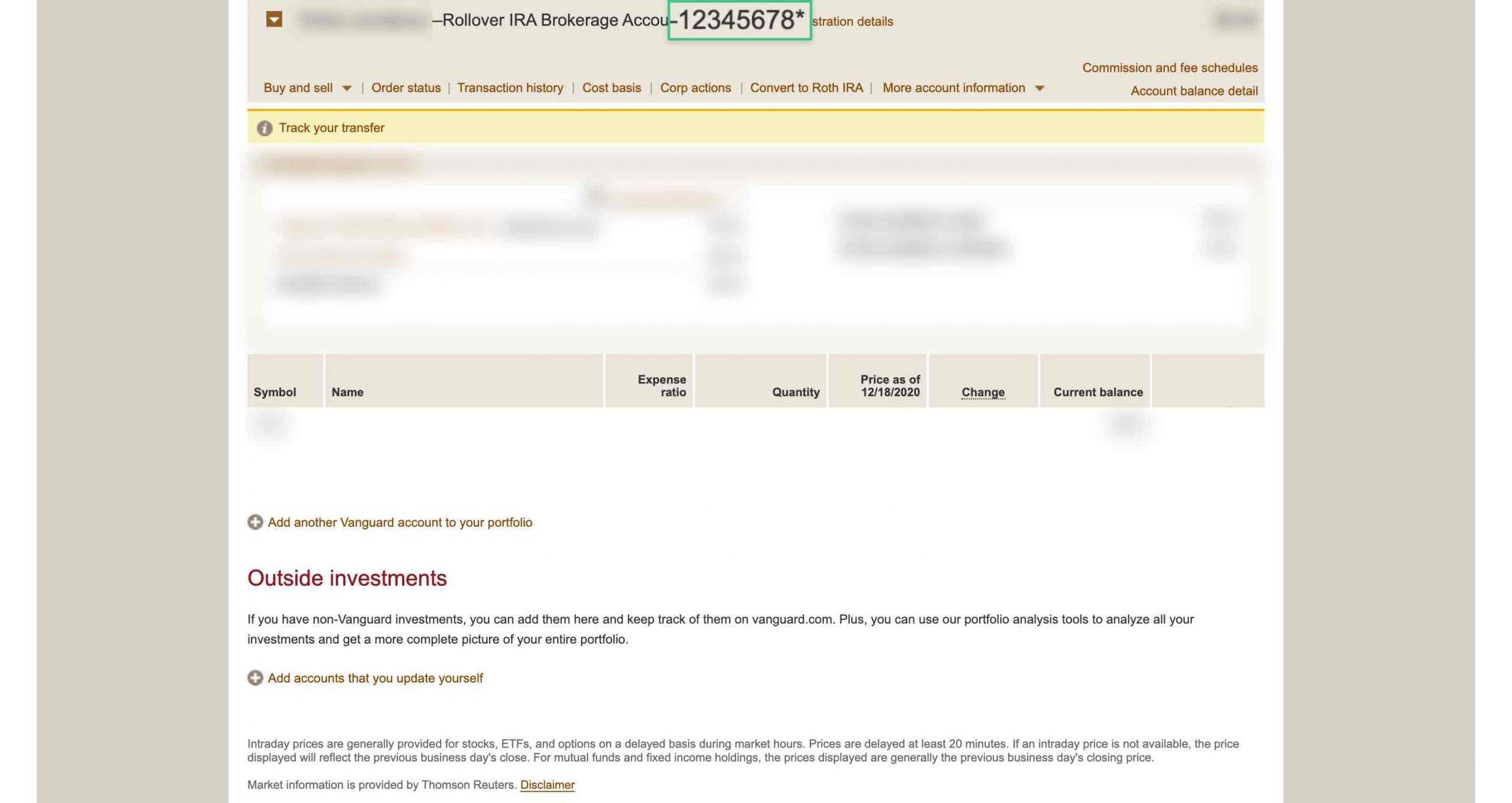

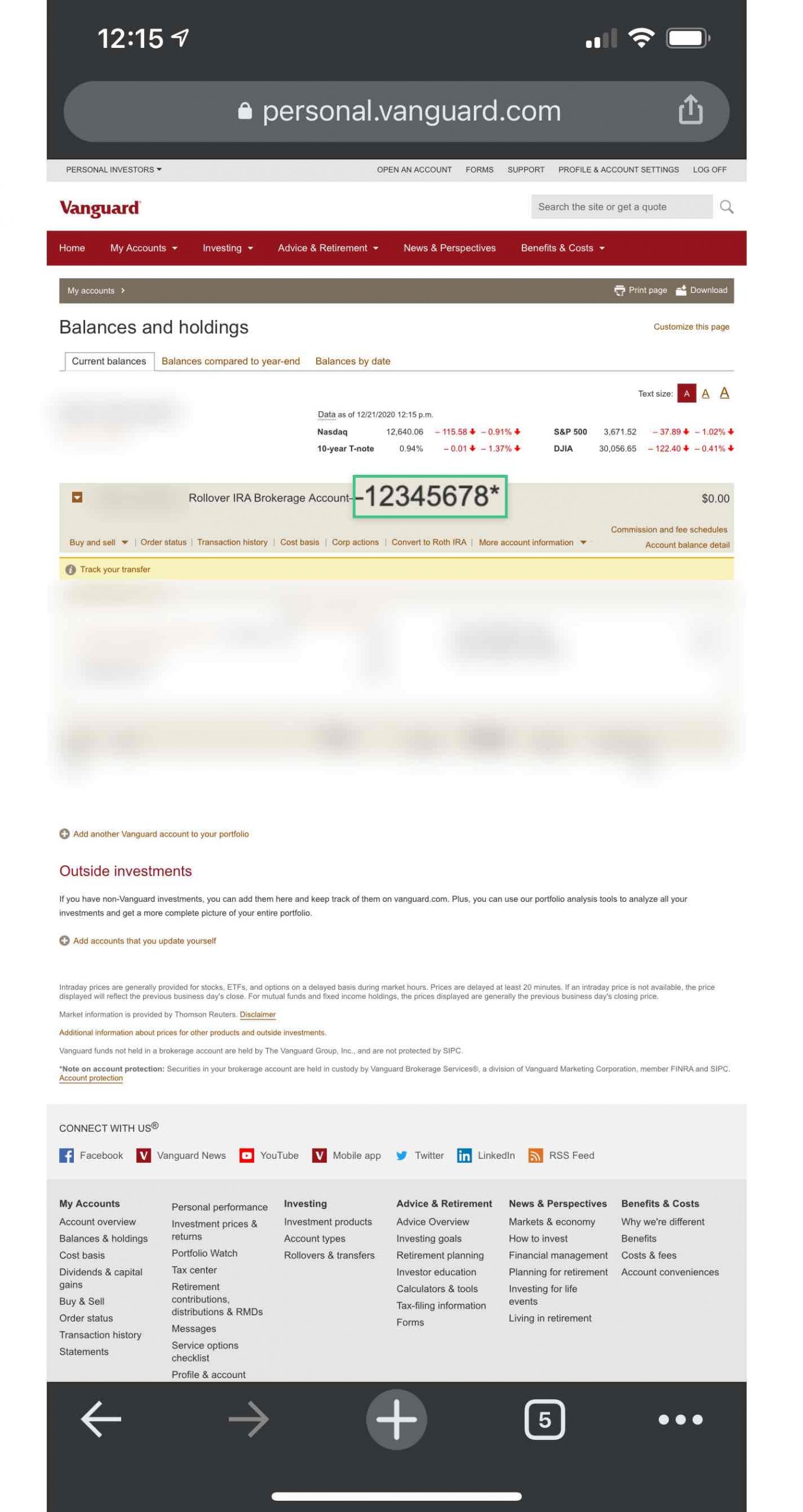

How to Find Your Vanguard Account Number – Capitalize - Source www.hicapitalize.com

Question 1: What is the Vanguard S&P 500?

The Vanguard S&P 500 is an index fund that tracks the performance of the S&P 500 Index, a widely recognized benchmark for the U.S. stock market. It passively invests in the 500 largest publicly traded companies in the United States, providing broad exposure to the American market.

Question 2: How has the Vanguard S&P 500 performed historically?

Over the long term, the Vanguard S&P 500 has delivered strong returns, reflecting the overall growth of the U.S. economy. Its annualized return since its inception in 1976 has consistently exceeded the inflation rate.

Question 3: What are the fees associated with the Vanguard S&P 500?

The Vanguard S&P 500 has extremely low expense ratios, typically around 0.03%. This means that investors pay a minimal fee to cover fund management and operating costs.

Question 4: Is the Vanguard S&P 500 a suitable investment for all investors?

The Vanguard S&P 500 is a versatile investment that can complement various portfolios. It is suitable for long-term investors who seek broad market exposure and are comfortable with the potential for market fluctuations.

Question 5: How can I invest in the Vanguard S&P 500?

Investing in the Vanguard S&P 500 is straightforward. Investors can open an account with Vanguard and purchase shares through various investment platforms.

Question 6: What are the potential risks and considerations when investing in the Vanguard S&P 500?

Like any investment, the Vanguard S&P 500 carries inherent risks, such as market volatility and economic downturns. Understanding these risks and assessing one's risk tolerance is crucial before investing.

This FAQ section has highlighted key aspects of the Vanguard S&P 500. For a comprehensive guide and additional insights, refer to the article, Vanguard S&P 500: A Comprehensive Guide To America's Premier Index Fund

Tips

For investors seeking broad exposure to the US stock market, the Vanguard S&P 500 Index Fund offers a cost-effective and diversified investment vehicle. To maximize the benefits of investing in this fund, consider the following tips:

Tip 1: Invest for the Long Term: The S&P 500 has a proven track record of growth over extended periods. Investors should adopt a long-term mindset and avoid short-term market fluctuations.

Tip 2: Regularly Contribute: Through dollar-cost averaging, regular contributions help mitigate market volatility and potentially enhance returns over time.

Tip 3: Rebalance Periodically: As your portfolio grows, it's essential to rebalance its asset allocation to maintain your desired risk-return profile.

Tip 4: Consider Tax-Advantaged Accounts: Investing in the Vanguard S&P 500 Fund through tax-advantaged accounts, such as IRAs or 401(k)s, can enhance tax efficiency.

Tip 5: Avoid Market Timing: It's impossible to predict market movements accurately. Instead, focus on a disciplined investment strategy that matches your financial goals and risk tolerance.

Tip 6: Monitor Fund Performance: While passive index funds like the Vanguard S&P 500 Index Fund typically track their underlying index closely, it's prudent to monitor the fund's performance and expense ratio regularly.

Tip 7: Seek Professional Advice: If you have complex financial concerns or are unsure about investing in the Vanguard S&P 500 Index Fund, consider consulting with a qualified financial advisor.

These tips can help investors harness the potential of the Vanguard S&P 500 Index Fund and potentially achieve their long-term financial objectives.

In conclusion, the Vanguard S&P 500 Index Fund provides a low-cost and convenient way to gain exposure to the US stock market. By following these tips, investors can make informed decisions, optimize their investment strategy, and potentially maximize their returns.

Vanguard S&P 500: A Comprehensive Guide To America's Premier Index Fund

The Vanguard S&P 500 is a widely diversified index fund that offers investors a low-cost way to track the performance of the S&P 500 Index, a broad measure of the U.S. stock market.

- Low-cost: The Vanguard S&P 500 has a low expense ratio of 0.04%, making it one of the most affordable index funds available.

- Broad diversification: The fund invests in all 500 companies that make up the S&P 500 Index, providing investors with exposure to a wide range of industries and sectors.

- Long-term track record: The fund has a long track record of success, having outperformed the S&P 500 Index over the past 10 years.

- Tax-efficiency: The fund is tax-efficient, meaning that it generates relatively low capital gains distributions.

- Transparency: The fund provides investors with a high level of transparency, making it easy to understand how the fund is managed and what stocks it holds.

- Accessibility: The fund is widely available to investors through a variety of platforms, making it easy to buy and sell shares.

Investors who are looking for a low-cost, broadly diversified, and tax-efficient way to invest in the U.S. stock market should consider the Vanguard S&P 500. The fund has a long track record of success and is a core holding for many investors.

Austal USA Launches Vanguard USV for U.S. Navy - Naval News - Source www.navalnews.com

Vanguard S&P 500: A Comprehensive Guide To America's Premier Index Fund

The Vanguard S&P 500 Index Fund is a popular choice for investors looking for a low-cost and diversified way to gain exposure to the US stock market. The fund tracks the S&P 500 index, which is composed of the 500 largest publicly traded companies in the US. As of 2023, the Vanguard S&P 500 Index Fund had over $800 billion in assets under management, making it one of the largest mutual funds in the world.

How to Find Your Vanguard Account Number – Capitalize - Source www.hicapitalize.com

There are several reasons why the Vanguard S&P 500 Index Fund is a good choice for investors. First, the fund is very diversified, which reduces the risk of losing money. Second, the fund has a low expense ratio of 0.04%, which means that investors keep more of their money. Third, the fund has a long track record of success, having outperformed the majority of other mutual funds over the past decade.

Of course, there are also some risks associated with investing in the Vanguard S&P 500 Index Fund. One risk is that the stock market can be volatile, and the fund's value can fluctuate significantly in the short term. Another risk is that the fund is not actively managed, which means that it does not attempt to beat the market. As a result, the fund's performance may not be as good as that of an actively managed fund.

Overall, the Vanguard S&P 500 Index Fund is a good choice for investors looking for a low-cost and diversified way to gain exposure to the US stock market. The fund has a long track record of success and is managed by a reputable company. However, investors should be aware of the risks associated with investing in the stock market before investing in the fund.

Table: Key Insights

| Key Insight | Explanation |

|---|---|

| The Vanguard S&P 500 Index Fund is a low-cost and diversified way to gain exposure to the US stock market. | The fund tracks the S&P 500 index, which is composed of the 500 largest publicly traded companies in the US. |

| The fund has a long track record of success, having outperformed the majority of other mutual funds over the past decade. | The fund has consistently beaten the S&P 500 index, as well as other actively managed funds. |

| The fund is not actively managed, which means that it does not attempt to beat the market. | This means that the fund's performance may not be as good as that of an actively managed fund. |

| Investors should be aware of the risks associated with investing in the stock market before investing in the fund. | The stock market can be volatile, and the fund's value can fluctuate significantly in the short term. |